In the fast-paced world of business, efficiency and agility are king. Streamlining operations and freeing up resources to focus on core competencies is more crucial than ever. One area often overlooked for potential optimization is accounts payable (AP). Managing invoices, approvals, and payments diligently consumes valuable time and manpower, diverting your focus from more strategic activities. This is where accounts payable outsourcing services come to the rescue.

What is Accounts Payable Outsourcing?

Accounts payable outsourcing involves delegating all or part of your AP tasks to a qualified third-party provider. These providers have the expertise, technology, and infrastructure to handle invoice processing, data entry, payment execution, and reporting, freeing your internal team to concentrate on other vital business functions.

Benefits of Outsourcing Accounts Payable

Outsourcing AP offers a range of benefits that can significantly improve your business performance, including:

1. Increased Efficiency and Reduced Costs

- Labor cost savings: Eliminate the need for dedicated AP staff and associated payroll expenses.

- Technology savings: Avoid investing in expensive AP software and hardware.

- Process optimization: Leverage the expertise of experienced AP professionals to streamline workflows and reduce processing times.

- Early payment discounts: Streamlined processes allow you to capture early payment discounts from vendors, boosting your cash flow.

2. Improved Accuracy and Compliance

- Reduced errors: Outsourcing providers have robust data entry and verification protocols, minimizing errors and discrepancies.

- Enhanced compliance: Stay ahead of complex tax regulations and accounting standards with expert guidance and automation.

- Fraud prevention: Benefit from advanced fraud detection tools and secure systems to safeguard your financial data.

3. Greater Scalability and Flexibility

- Accommodate business growth: Easily scale your AP operations up or down as your business needs evolve.

- Focus on core business: Free your internal team to dedicate their time to strategic initiatives that drive growth.

- Greater control and visibility: Enjoy real-time access to accurate data and reports for informed decision-making.

4. Access to Professional Accounting Services

- Expertise beyond AP: Many outsourcing providers offer additional accounting consulting services, providing broader financial insights and support.

- Strategic guidance: Gain access to experienced accounting professionals who can help optimize your entire financial system.

- Customized solutions: Benefit from tailored AP solutions that align with your specific business needs and industry.

Also Read : Accounts Receivable 2024 : 6 Game-Changing Trends Taking Hold

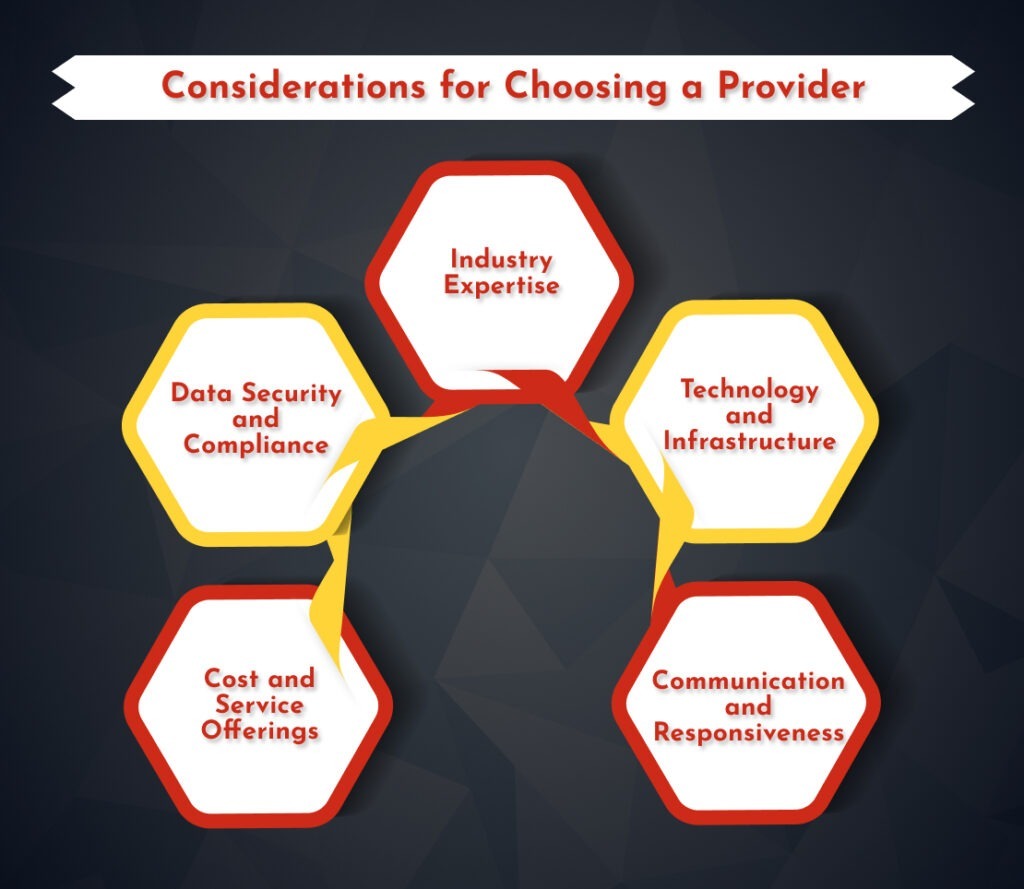

Considerations for Choosing a Provider

While the benefits of outsourcing accounts payable are clear, selecting the ideal partner is crucial for a smooth and successful transition. Here’s a deeper dive into key considerations to ensure you find the perfect fit:

1. Industry Expertise

- Look for providers specialized in your industry. They’ll understand your specific regulations, tax complexities, and common vendor relationships, reducing onboarding time and streamlining processes.

- Inquire about experience with businesses of similar size and volume. This ensures the provider can accommodate your current needs and scale with your future growth.

2. Data Security and Compliance

- Prioritize providers with rigorous data security protocols. Ask about encryption standards, secure data storage, and access control measures.

- Ensure compliance with relevant accounting regulations and industry standards. Look for certifications like SOC 2 and AICPA SOC reports for added assurance.

3. Technology and Infrastructure

- Evaluate the provider’s technology platform. Assess its features, ease of use, integration capabilities with your existing systems, and automation potential.

- Inquire about the provider’s infrastructure redundancy and disaster recovery plans. This ensures uninterrupted service and data protection in case of unexpected events.

4. Cost and Service Offerings

- Compare pricing models carefully. Some providers charge per invoice, transaction, or user, while others offer fixed monthly fees. Choose a model that aligns with your budget and volume.

- Scrutinize the service packages offered. Look for services like invoice capture, data entry, payment processing, reporting, and dispute resolution to ensure a comprehensive solution.

5. Communication and Responsiveness

- Assess the provider’s communication channels and response times. Ensure they offer clear channels for regular updates, questions, and concerns.

- Schedule a call or meeting to gauge their responsiveness and communication style. A comfortable rapport is crucial for a successful partnership.

Conclusion

By outsourcing your accounts payable, you can unlock a range of benefits, from cost savings and increased efficiency to improved accuracy and access to professional accounting services. This, in turn, frees your internal team to focus on strategic initiatives that drive growth and success. In today’s competitive landscape, embracing innovative solutions like accounts payable outsourcing can be the key to unlocking your business’s true potential.

Drowning in invoices? Let vteam’s expert account payable outsourcing be your life raft! Streamline processes, slash costs, and gain control. Focus on what matters while we handle the paperwork. Contact vteam today!