Financial and management reporting are integral components of a business’s information ecosystem, providing essential insights for decision-making and transparency. In this article, we will delve into the roles and significance of financial and management reporting services, exploring their impact on business management and financial decision-making.

Financial Reporting

Financial reporting serves as the backbone of a company’s communication with external stakeholders, offering a comprehensive view of its financial health. The primary objectives include presenting an overview of financial performance, complying with regulatory standards, and meeting the requirements of generally accepted accounting principles (GAAP financial reporting).

Purpose and Objectives

Financial reporting aims to communicate a company’s financial status to external stakeholders. This involves preparing key financial statements such as the Income Statement, Balance Sheet, and Cash Flow Statement. These statements provide a snapshot of the company’s profitability, assets and liabilities, and cash flow.

Components of Financial Reporting

- Income Statement: Reflects revenue, expenses, and profitability over a specific period.

- Balance Sheet: Presents the company’s assets, liabilities, and equity at a particular point in time.

- Cash Flow Statement: Highlights the cash inflows and outflows, offering insights into liquidity.

Stakeholders and their Interests

- Investors: Evaluate the company’s financial health and potential returns on investment.

- Creditors: Assess the company’s ability to meet its financial obligations.

- Government and Regulatory Bodies: Ensure compliance with financial regulations.

Management Reporting

While financial reporting caters to external stakeholders, management reporting services are designed to support internal decision-making processes, offering insights into operational performance and aiding strategic planning.

Purpose and Objectives

Management reporting services aim to provide timely and relevant information for internal decision-making. This includes Key Performance Indicators (KPIs), budgetary considerations, and variance analysis.

Components of Management Reporting

- Key Performance Indicators (KPIs): Metrics aligned with organizational goals, offering insights into performance.

- Budgets and Forecasts: Financial plans that guide resource allocation and goal setting.

- Variance Analysis: Examining the differences between planned and actual performance to identify areas for improvement.

Stakeholders and their Interests

- Managers and Executives: Rely on management reports for strategic decision-making.

- Department Heads: Utilize reports to monitor and optimize the performance of their respective departments.

- Employees: Benefit from clear communication and understanding of the company’s goals.

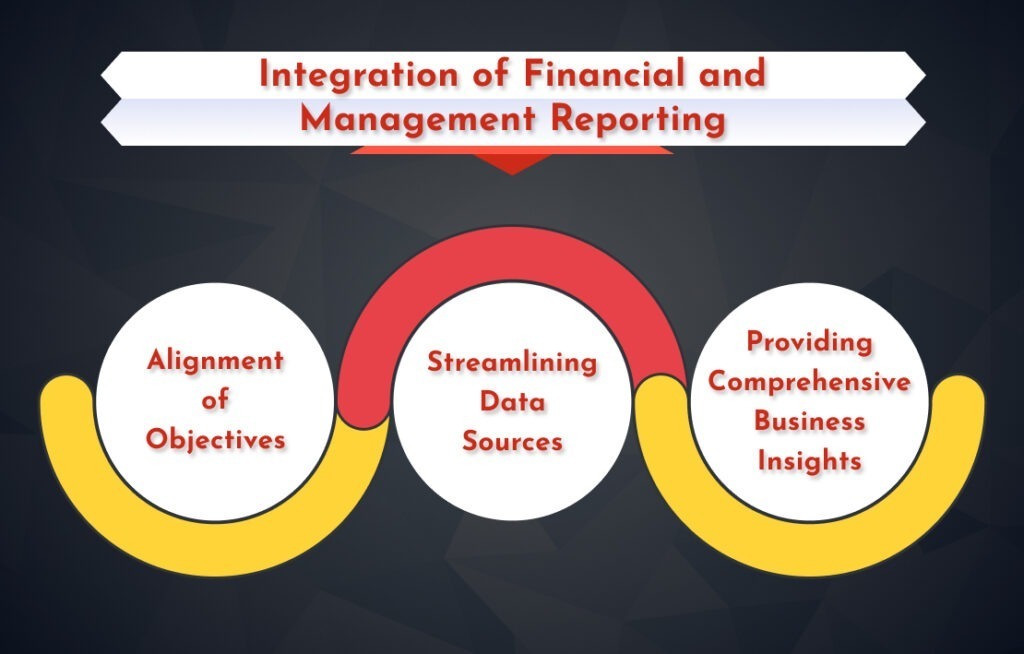

Integration of Financial and Management Reporting

Aligning financial and management reporting is crucial for a holistic view of a company’s performance. This involves ensuring consistency in objectives, streamlining data sources, and providing comprehensive business insights.

Alignment of Objectives

Harmonizing the goals of financial and management reporting ensures that both functions contribute effectively to the company’s success.

Streamlining Data Sources

Integrating data sources helps eliminate discrepancies and ensures that both types of reporting draw from the same accurate and up-to-date information.

Providing Comprehensive Business Insights

The synergy between financial and management reporting results in a more comprehensive understanding of the business, facilitating better decision-making at both operational and strategic levels.

Technology and Reporting

The advent of technology has significantly impacted financial and management reporting services, enhancing accuracy, efficiency, and accessibility.

Role of Information Systems

Modern information systems play a pivotal role in data collection, processing, and reporting. They automate routine tasks, reducing the risk of human error.

Automation and Reporting Tools

Automation tools streamline the reporting process, allowing for faster and more accurate generation of reports. Reporting tools provide dynamic visualization and analysis capabilities.

Impact of Technology on Reporting Accuracy and Efficiency

Technology has improved the accuracy of reporting by minimizing manual interventions and has made reporting more efficient through real-time data processing.

Challenges in Reporting

Despite the benefits, financial and management reporting services face challenges that organizations need to address to ensure the reliability and relevance of the information provided.

Timeliness and Accuracy

Balancing the need for timely reporting with the requirement for accuracy poses a constant challenge, especially in dynamic business environments.

Data Integrity and Quality

Maintaining the integrity and quality of data is crucial for reliable reporting. Inaccurate or incomplete data can lead to misguided decisions.

Regulatory Compliance

Staying compliant with evolving regulations and accounting standards requires continuous monitoring and adaptation of reporting practices.

Best Practices in Financial and Management Reporting

Adhering to best practices is essential to overcome challenges and ensure the effectiveness of financial and management reporting services.

Establishing Clear Reporting Policies

Clearly defined reporting policies help standardize the reporting process, reducing the likelihood of errors and ensuring consistency.

Continuous Monitoring and Evaluation

Regular monitoring and evaluation of reporting processes allow organizations to identify areas for improvement and maintain the relevance of reports.

Training and Development of Reporting Teams

Investing in the training and development of reporting teams ensures that they are equipped with the skills and knowledge needed to produce accurate and meaningful reports.

Future Trends in Reporting

As technology continues to evolve, the future of financial and management reporting services is likely to be shaped by emerging trends that enhance the efficiency and depth of reporting.

Use of Artificial Intelligence and Predictive Analytics

AI and predictive analytics will play a more prominent role in forecasting and decision support, providing valuable insights for strategic planning.

Enhanced Visualization and Reporting Dashboards

Reporting will become more user-friendly and accessible with the development of enhanced visualization tools and interactive dashboards.

Evolving Regulatory Landscape

Businesses must stay vigilant in adapting to an ever-changing regulatory landscape, ensuring compliance with new standards and requirements.

Conclusion

Financial and management reporting services are indispensable for businesses, serving the dual purpose of meeting external obligations and facilitating internal decision-making. As technology continues to advance, organizations must embrace these changes to enhance the accuracy, efficiency, and relevance of their reporting practices. Adhering to best practices, addressing challenges, and staying attuned to future trends will ensure that financial and management reporting remains a valuable asset in the dynamic landscape of business management and financial decision-making.

Accelerate your business success with vteam’s cutting-edge Financial and Management Reporting services. From meticulous GAAP financial reporting to strategic management insights, we tailor solutions to optimize your decision-making processes. Trust vteam for unparalleled excellence in financial management and reporting services.